How 1047 Games spent $409k on influencers on Splitgate 2's failed launch

Welcome to my ongoing deep dives into influencer marketing for major game launches! Today I'm breaking down 1047 Games' recently released "Splitgate 2," which launched on June 6th.

These analyses leverage Streamforge's tech to give marketers transparent, actionable insights into how publishers are allocating influencer budgets. My goal remains consistent: help industry professionals benchmark their campaigns and uncover strategies that work.

I'm not affiliated with 1047 Games, and all budget figures are estimates based on publicly available data and market rates from Streamforge's algorithm.

A Chronological Overview

Splitgate 2's journey from announcement to launch represented a carefully orchestrated campaign that built momentum through strategic reveals and community engagement:

August 15, 2024 - Initial announcement trailer debuts at Gamescom Opening Night Live, revealing the sequel with enhanced graphics and new game modes

October 2024 - Extended gameplay showcase during Steam Next Fest, featuring the new battle royale mode alongside classic arena gameplay

January 2025 - "Evolving the Portal" developer diary series launches, explaining design philosophy behind new features

March 18, 2025 - Closed beta announcement with sign-ups opening for PC and console players

May 2-15, 2025 - Open beta period across all platforms, generating significant community feedback and content creation

May 28, 2025 - Final pre-launch trailer "Portal to Victory" released, confirming June 6th release date

June 6, 2025 - Global launch on PC (Steam, Epic Games Store), PlayStation 5, and Xbox Series X|S

What stands out about this timeline is the emphasis on playable builds, with both closed and open beta periods allowing the community extensive hands-on time before launch. This strategy proved to be a double-edged sword, as early feedback revealed mixed reactions to the new direction.

The Twitch Drops Program

Split into three back-to-back, two-week rounds. Within each round, viewers earn one reward after 2 h, 4 h, and 6 h of watch time on any “DropsEnabled” stream.

By opening Drops to every streamer, Splitgate 2 replicated Kingdom Come Deliverance 2’s broad-access approach, driving organic uptake without additional budget. The three-round structure gave viewers fresh goals every two weeks, encouraging repeat tuning-in and steadily boosting total watch time.

Experiential Arcade Booth at Gamescom

Partnering with FGPG, Splitgate 2’s 77×77-foot faction recruitment zone at Gamescom felt like a live mini-tournament. Visitors chose a specific faction, either Aeros, Sabrask or Meridian, by racing through agility ladders, pushing weighted sleds or lining up precise beanbag throws, then jumped straight into 4v4 demo matches across 24 stations. LED walls above them replayed every clutch portal play, while branded lanyards and faction pins reinforced that sense of team pride.

Summer Game Fest Stage Reveal

At the YouTube Theater in Los Angeles on June 6, 2025, during Summer Game Fest's main show, 1047 Games CEO Ian Proulx delivered what would become one of gaming's most tone-deaf presentations. After premiering Splitgate 2's Battle Royale trailer to an estimated 50 million livestream viewers, Proulx donned a "Make FPS Great Again" cap while aggressively criticizing rival franchises, stating he was "tired of playing the same Call of Duty every year."

The political slogan immediately sparked backlash, with PCGamesN calling it "tone-deaf" and Reddit users labeling it a "dog whistle." But the real damage came when players discovered the game's $70-80 cosmetic bundles, leading to accusations of hypocrisy from a developer positioning itself as anti-establishment. Proulx later claimed the pricing was "news to me" and blamed a former Call of Duty monetization executive, further damaging credibility.

This combination of controversial messaging and aggressive monetization created a perfect storm that overshadowed any positive reception the influencer campaign might have generated.

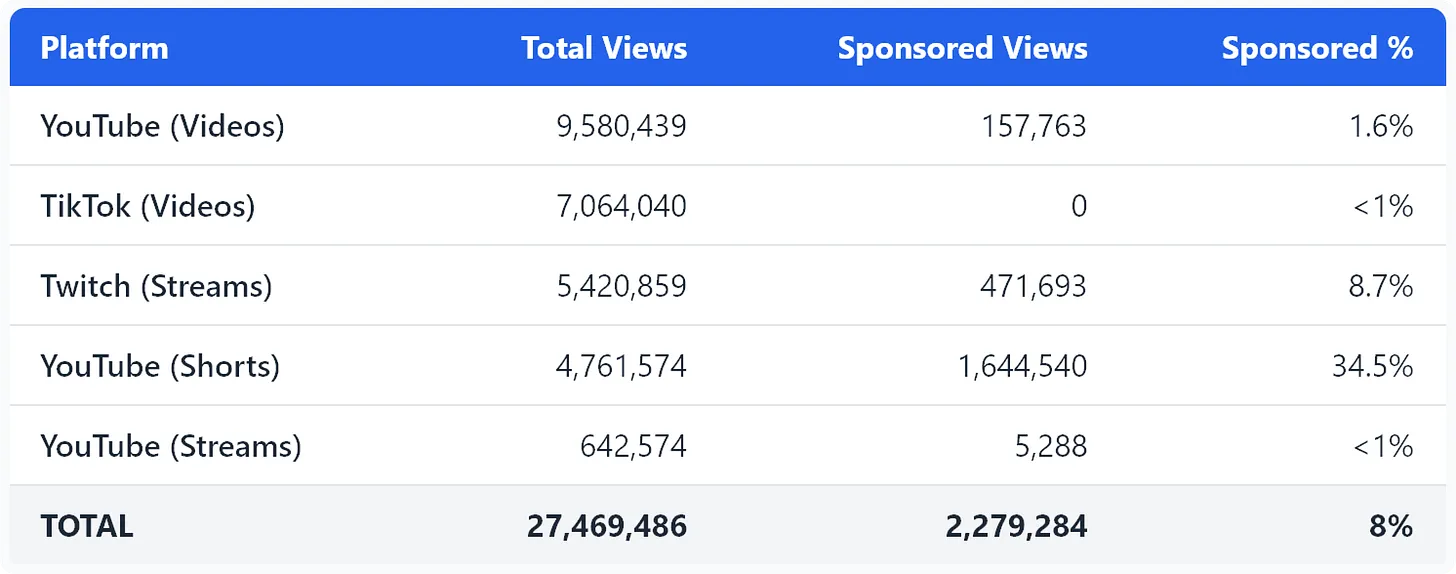

Content Volume and Platform Distribution

From the week before Splitgate 2's launch (May 30th) to one week after release (June 13th), the game generated 27.47 million views across all platforms.

The sponsored content rate was 8% overall, which sits between what we observed with Assassin's Creed Shadows (6.6%) and RuneScape: Dragonwilds (5%). Notably, YouTube Shorts had an unusually high sponsored rate at 34.5%, suggesting 1047 Games made a concentrated push into short-form content.

YouTube Videos dominated viewership with 9.58 million views (34.9% of total), while TikTok generated 7.06 million views (25.7%) completely organically. Twitch streams captured 5.42 million views (19.7%), showing strong live engagement around the shooter.

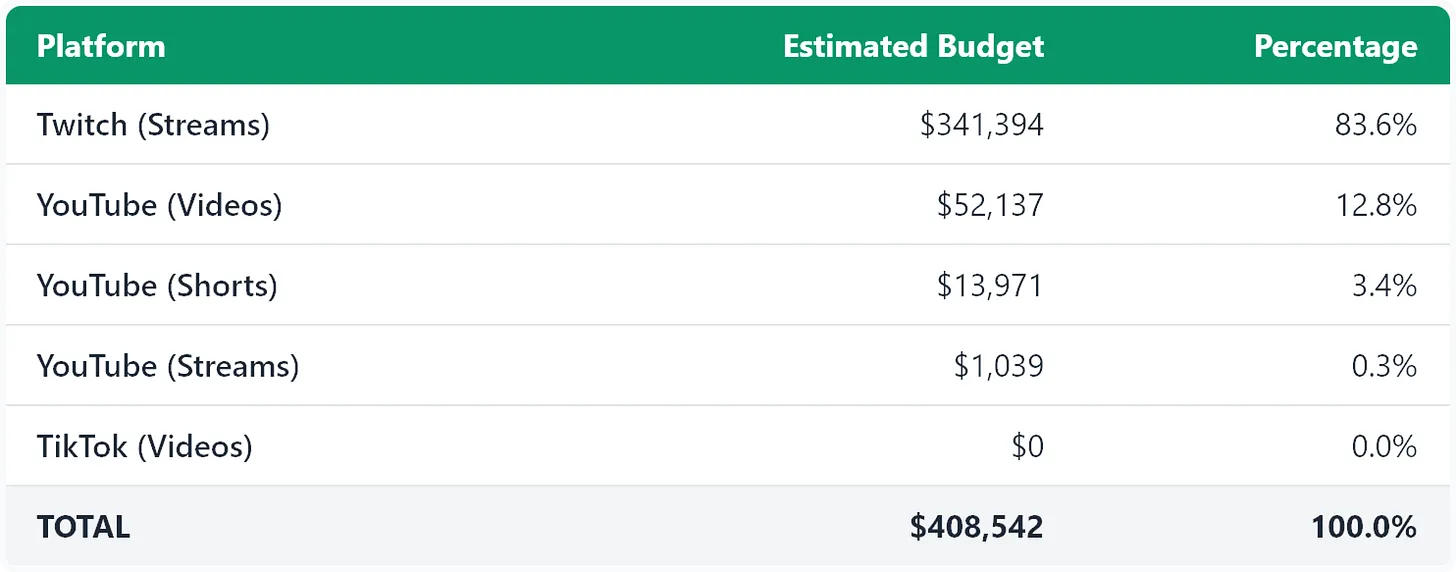

Budget Allocation Breakdown

1047 Games' estimated $408,542 influencer marketing budget for Splitgate 2 was overwhelmingly concentrated on Twitch, which received 83.6% of the total investment despite generating less than 20% of total views.

This extreme platform concentration rivals what we saw with Dune: Awakening's closed beta (95% Twitch allocation) and exceeds even RuneScape: Dragonwilds' heavy Twitch emphasis (89%). Investing in Twitch seems to be the go-to for any shooter releasing lately.

YouTube Videos received 12.8% of budget, while YouTube Shorts captured just 3.4% despite generating nearly 5 million views. TikTok received zero investment despite generating over 7 million organic views, representing a significant missed opportunity.

Market Capture Analysis

For analyzing Splitgate 2's market capture, I defined a targeting group focused on arena shooters and fast-paced FPS games that share similar mechanics or audience appeal.

Targeting Group:

Overwatch 2

Apex Legends

Valorant

Halo Infinite

Rocket Arena

Titanfall 2

Portal series

Team Fortress 2

Quake Champions

Splitgate (original)

The data shows modest conversion rates: Splitgate 2 captured approximately 2% of relevant Twitch creators and 1% of YouTube creators from this target group. These figures are significantly lower than standout performers like inZOI (19%) or DOOM: The Dark Ages (35% on YouTube), and even trail recent releases like Atomfall (7% combined).

To be fair, the FPS genre is massive.

The low capture rates are particularly surprising given the original Splitgate's popularity among content creators and the franchise's built-in audience. This suggests the new direction and mixed reception may have dampened creator enthusiasm.

Cost Efficiency Analysis

The cost-per-thousand-views analysis reveals dramatic efficiency differences between platforms. YouTube Shorts delivered exceptional value at just $8 CPM, making it the most cost-effective format analyzed to date. TikTok received no investment despite generating 7+ million organic views.

Twitch's $723 CPM falls on the higher end compared to recent campaigns, exceeding Clair Obscur ($423) and approaching DOOM's premium rate ($756). This suggests either 1047 Games paid premium rates for top talent, or the sponsored streams underperformed expectations.

YouTube Videos at $330 CPM and YouTube Streams at $196 CPM both represent reasonable efficiency, though the minimal investment in these formats limited their impact.

Creator Demographics and Targeting

The demographic distribution reveals a heavily US-focused campaign, with 76% of sponsored creators based in America. This concentration is higher than most campaigns I've analyzed, suggesting 1047 Games viewed North America as their primary market.

The gender split shows traditional FPS demographics, with 82.6% male creators receiving sponsorships. However, the 13% allocation to female creators is respectable for the shooter genre, indicating some effort to broaden appeal.

Age targeting focused almost exclusively on the 25-34 bracket (91.3%), with minimal investment in younger creators despite the 18-24 demographic's strong presence in competitive gaming.

Top Creators Hired

1047 Games' creator selection strategy reveals a focus on established FPS personalities and variety streamers:

summit1g ($25,756) - The natural champion choice, given his massive Twitch following and expertise with competitive shooters. His streams consistently deliver high engagement for FPS content.

lydiaviolet ($21,460) - A strong variety streamer whose audience appreciates skilled gameplay across multiple genres.

Grizzy ($21,460) - The sole major YouTube investment, bringing his comedic commentary style to showcase the game's more entertaining moments.

joe_bartolozzi ($12,426) - Popular among younger audiences, helping bridge generational gaps in the shooter community.

The relatively modest investment in any single creator (compared to Assassin's Creed Shadows' $76K+ for HasanAbi) suggests 1047 Games spread their budget across a broader range of mid-tier talent rather than betting heavily on megastars.

The Reality Check

Despite the $408k influencer investment and 27.4 million total views, Splitgate 2's launch was catastrophic. The game lost over 96% of its Steam player base within a month, dropping from 25,785 concurrent players at launch to under 1,000 by early July. Steam reviews settled at "Mixed" (60% positive), with many players criticizing the diminished role of portals and generic map design.

Professional critics echoed these concerns, with PC Gamer (60/100) and IGN (7/10) noting that the sequel felt like a "less interesting version of Apex Legends" that had lost the original's unique identity. The move to mainstream appeal had alienated the core fanbase without attracting sufficient new players.

The Aftermath

By late June 2025, 1047 Games was forced to lay off employees and implement emergency patches addressing community feedback. The studio shifted from aggressive expansion mode to damage control, with co-founders forfeiting salaries to keep the project alive. While they've since added Ranked Play and other requested features, the question remains whether these changes came too late to salvage the game's reputation and player base.

My Thoughts

Splitgate 2 represents a fascinating case study in how influencer marketing alone cannot save a fundamentally flawed product strategy. The $408k budget and decent creator lineup (summit1g, HutchMF, erobb221) generated solid engagement metrics, but these meant nothing when the game itself disappointed.

The 83.6% Twitch focus made sense for showcasing gameplay depth, and the 2% market capture rate was actually respectable for the crowded FPS space. However, all this investment was undermined by strategic failures: the controversial presentation, aggressive monetization, and a game that critics felt had lost its unique identity.

Most tellingly, 1047 Games laid off staff within weeks of launch and the co-founders forfeited their salaries. This serves as a stark reminder that no amount of influencer marketing can compensate for poor product-market fit and tone-deaf messaging.

The campaign's technical execution was solid, but it was ultimately marketing a product that had alienated its core audience in pursuit of mainstream appeal. Sometimes the best influencer strategy can't overcome fundamental positioning failures.

Want to See More Data?

To view the full list of sponsored creators for Splitgate 2, head over to Streamforge.com and create a free account. Registration is quick and free, and you'll gain access to each creator's key metrics, AI-analyzed interests, entire content library, and detailed demographic breakdowns.

After registering, head to the Lists page, and click "Public Lists" to see the list.

What's Next

My next analysis will cover a title that's generating significant buzz in the space. Hit the subscribe button to get notified when it's released!

What do you think about these findings? Please let me know if you find value in these analyses - they take considerable time to research and write! Share your thoughts in the comments.